Profumo Solido Di Alta Qualit¢ Jo Malone Rosa Bianca Muschiato Assoluto 3 4 Oz / 100 Ml Di Colonia Unisex Spray Buon Odore Con Ultima Capacit¢ Di Lunga Capacit¢ Dhzh1 Da 26,59 € | DHgate

Profumo di aromaterapia per auto Jo Malone London presa d'aria profumo solido auto appeso dispositivo automobilistico montaggio regolazione del nastro _ - AliExpress Mobile

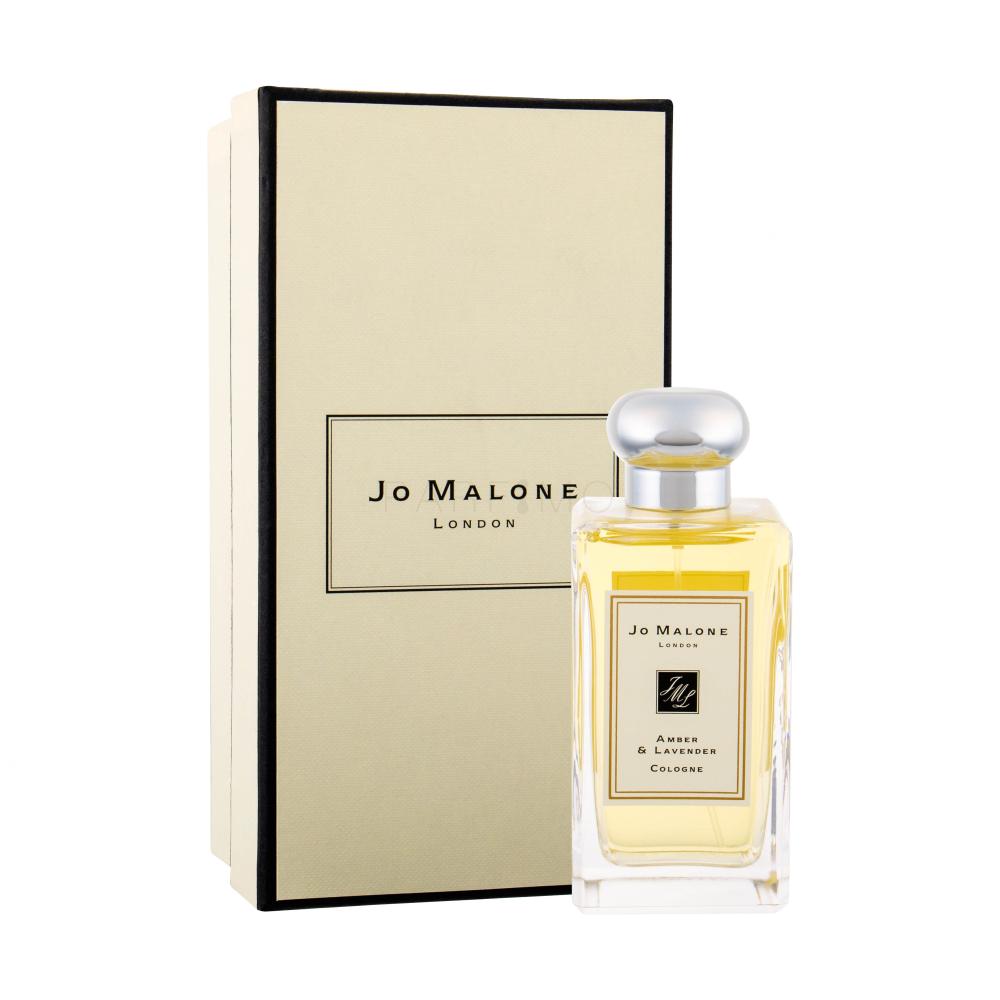

Profumo Solido Di Alta Qualit¢ Jo Malone Rosa Bianca Muschiato Assoluto 3 4 Oz / 100 Ml Di Colonia Unisex Spray Buon Odore Con Ultima Capacit¢ Di Lunga Capacit¢ Dhzh1 Da 26,59 € | DHgate