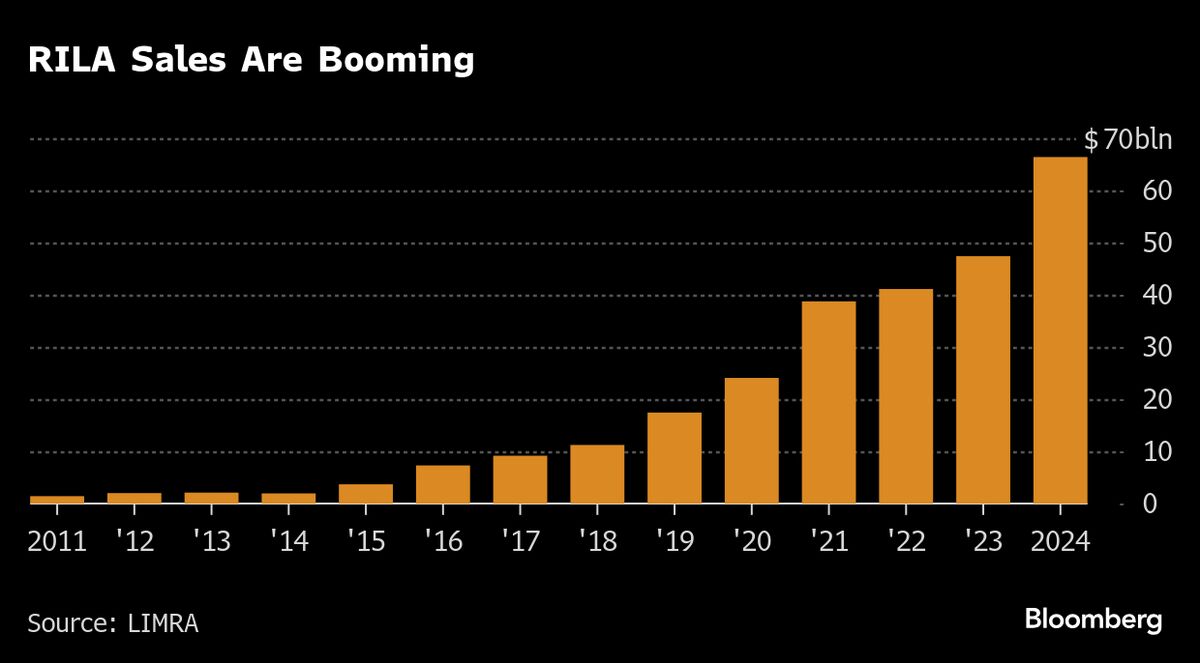

Distortions Hit Equity Funding, Dividend Curve as ‘RILAs’ Boom

Distortions are emerging in two small but important corners of the US equity market, in a fresh demonstration of how Wall Street’s obsession with derivatives-powered products is reshaping the investment landscape.

Funding costs embedded in the price of S&P 500 futures — what an investor pays in exchange for gaining economic exposure to the index without having to put up all the money — have been steadily climbing in recent months, with some measures at or near a record. Meanwhile dividend futures — which let an investor take a view on company payouts — show unusually subdued expectations in the coming years, bucking the trend of the past decade.

Do you want to build your own blog website similar to this one? Contact us