JPMorgan Cuts Colgate-Palmolive (CL) Price Target to $88, Keeps Overweight Rating Ahead of Q3 Results

Colgate-Palmolive Company (NYSE:CL) is included among the 15 Dividend Stocks that Have Raised Payouts for 20+ Years.

Colgate-Palmolive Company (NYSE:CL) is down by nearly 14%, which has made analysts worried about its outlook.

On October 10, JPMorgan has lowered its price target for Colgate-Palmolive Company (NYSE:CL) from $95 to $88 while keeping an Overweight rating on the stock ahead of the company’s third-quarter 2025 earnings release.

The consumer products leader is set to report its Q3 results on Friday, October 31, before the market opens. JPMorgan attributed the reduced price target to softer performance across product categories. Although Colgate-Palmolive Company (NYSE:CL) maintained its overall full-year 2025 guidance for both revenue and earnings, the company now expects organic sales growth to land at the lower end of its previously projected 2% to 4% range due to weaker category trends.

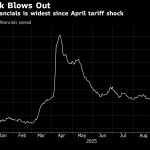

However, several positive factors have helped balance these headwinds. More favorable foreign exchange conditions have allowed management to reaffirm its outlook for low-single-digit net sales growth. In addition, while tariff-related costs have improved by $125 million, now expected to total around $75 million, these savings are largely offset by higher expenses for raw and packaging materials.

Despite these near-term pressures, Colgate-Palmolive Company (NYSE:CL) remains a reliable income stock, as the company has been growing its dividends for 62 consecutive years. The company offers a quarterly dividend of $0.52 per share for a dividend yield of 2.66%, as of October 16.

While we acknowledge the potential of CL as an investment, we believe certain AI stocks offer greater upside potential and carry less downside risk. If you’re looking for an extremely undervalued AI stock that also stands to benefit significantly from Trump-era tariffs and the onshoring trend, see our free report on the best short-term AI stock.

READ NEXT: 12 Must-Buy Dividend Stocks to Invest in and 11 Defensive Healthcare Dividend Stocks To Buy Now.

Disclosure: None.

Do you want to build your own blog website similar to this one? Contact us